How Companies Leverage the IMMEX Program Today

07.18.24The proximity to the U.S., low cost of labor in Mexico, and industrial talent availability are all advantages foreign manufacturers have profited from for decades. When the IMMEX program was launched in the mid-1960s, it incentivized U.S. and other foreign manufacturers to operate in Mexico, and since then, the industry has only continued to grow.

However, there are certain key benefits many U.S. and other foreign manufacturers may not be fully aware of, including sales, profits, and tax savings, which may further drive them to explore the potential of manufacturing in Mexico.

Sales and Profits Don’t Stay with Mexico

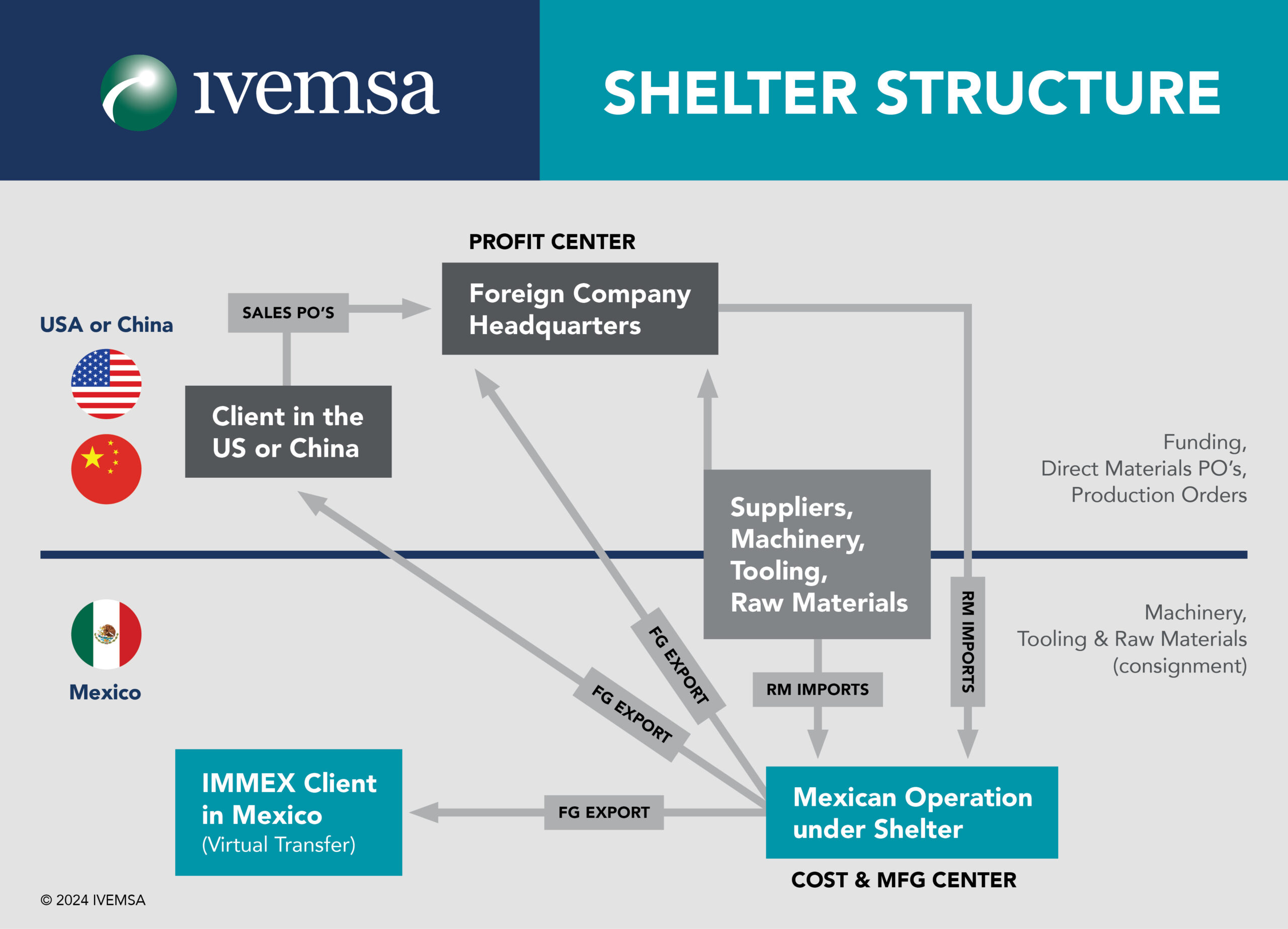

When operating as part of the IMMEX program, under a shelter company like IVEMSA, foreign manufacturers will guarantee to have the fastest operations startup possible with full access to the IMMEX program benefit. Additionally, under the IMMEX program, all sales and profits remain in the U.S. (or the country of origin) and are not withheld by the shelter or Mexico´s legal entity.

Furthermore, shelter services in Mexico include setting up facilities, utilities, and administrative departments every foreign manufacturer needs to launch production. Purchases for raw materials and resources are often completed in the U.S., and then moved to Mexico. Whereas, IVEMSA handles the local expenses which helps to streamline the management of profits and expenses. Every local expense must be approved by the client and then IVEMSA will take care of the accounts payable process.

Mexico Taxes Under the IMMEX Program

In Mexico, corporate taxes are related to the expense of the operation or the amount of assets and inventories that the company has in their operation; the formula utilized to obtain the tax base for the Mexico IMMEX operation is known as “Safe Harbor.” Safe Harbor rules allow foreign manufacturers operating as part of the IMMEX program to determine their tax profit base at the greater amount that results after applying the following:

- 9% assets – Includes all fixed assets, non-resident party’s fixed assets, and inventory used in the operation

- 5% costs and expenses – Includes the manufacturer’s costs and expenses and non-resident party expenses used in the operation

Also, per the special tax regime under the IMMEX program, approved U.S. and other foreign manufacturers are exempt from the 16% value-added tax (VAT) on temporary imports. They are automatically VAT tax-certified when operating under a shelter which means they can receive these tax savings from day one, as soon as the IMMEX program extension is approved and connected to the address of the leased facility.

Additionally, per the USMCA, manufacturers operating within the trading bloc do not have to pay duties on temporary imports with a confirmed USMCA certificate of origin. The U.S., Mexico, and Canada continually seek trade integration within North America and will continue a path that incentivizes trade among these three countries.

Stay Nimble with Shelter Services in Mexico

Although there are longstanding benefits to manufacturing in Mexico, there are constant changes that can make the option even more advantageous. Operating under a shelter allows U.S. and other foreign manufacturers to concentrate on production without having to track the complexities of setting up their own entity.

Shelter services in Mexico allow companies to stay flexible and scale up or down as needed. Plus, it helps to ensure manufacturers maximize the opportunity nearshoring provides with the guidance of a local expert.

For more information about the IMMEX program and how IVEMSA can help you capitalize on the benefits, contact us today.