Mexico is the Most Alluring Emerging Market

04.10.17 Bloomberg recently analyzed several factors of global markets for investors, including growth, yields, and equity valuations, and found Mexico to be the most attractive among emerging markets.

Bloomberg recently analyzed several factors of global markets for investors, including growth, yields, and equity valuations, and found Mexico to be the most attractive among emerging markets.

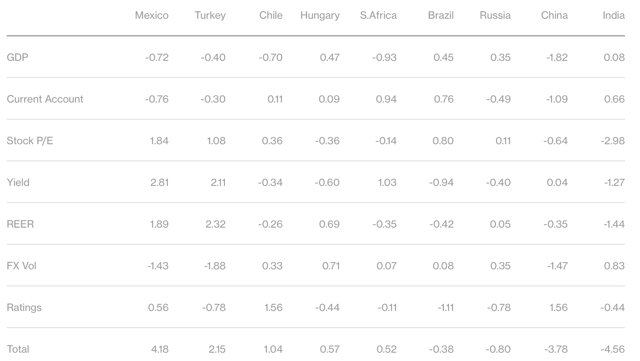

Nine of the ten countries that JPMorgan Chase & Co.’s listed in its Emerging Market Currency Index were analyzed by Bloomberg. Countries analyzed include Mexico, Turkey, Chile, Hungary, South Africa, Brazil, Russia, China, and India.

The following chart exemplifies the attractiveness of the emerging markets based on criteria including GDP growth, valuations, ratings, and volatility. Mexico was found to have high bond yields as well as attractive price/earnings ratio.

The attractiveness of each country is based on the following criteria:

- Forecast current-account balance for 2017 relative to GDP

- Forecast growth in gross domestic product for 2017

- Implied foreign-exchange volatility

- Price-earnings ratio for the key stock index

- Real-effective exchange rate based on data from Bank for International Settlements

- Sovereign credit rating

- Ten-year bond yield

Mexico remains an attractive emerging market for foreign investors.

For more information on how your company can grow in Mexico, contact IVEMSA, the Mexican manufacturing expert and for more information on Mexico’s attractiveness as an emerging market, read the entire Bloomberg article.